Forgiveness Planning for Income-Driven Repayment Plans

If you are using income-driven repayment (IBR, PAYE, REPAYE), you may wonder “How much do I need to save? What type of account should I use for these savings?

When you reach the maximum number of payments under an income-driven repayment plan, any remaining unpaid interest or student loan principal is forgiven. Currently, these forgiven amounts are treated as “canceled debt” by the IRS (https://www.irs.gov/taxtopics/tc431.html). Generally, canceled debt is treated as ordinary income and taxed at your marginal income tax rate during the tax year the debt is forgiven.

In order to plan for the taxes on student loan forgiveness, you’ll need three pieces of information:

- The estimated amount of debt forgiven

- The estimated tax rate on forgiven amounts

- A monthly savings target sufficient enough to cover the projected tax due, assuming some annual rate of return on saved amounts.

The amount of student loan forgiveness

The amount forgiven depends on numerous factors including your current and future income, your family size, marital status, spouse's income, spouse’s federal student debt balance, tax filing status, and when you start using income-driven repayment. Some of these factors change frequently. Utilizing tools like the VIN Foundation Student Loan Repayment Simulator or the Department of Education’s Repayment Estimator can help you estimate your loan repayment projection using your current data and situation.

The estimated tax rate on forgiven amounts

No one can tell you what the income tax rates will be when your taxable loan forgiveness occurs. However, we can make some educated guesses based on historical and current federal and state income tax rates. The highest federal income tax rate for 2020 is 37% and begins at incomes over $518,400 for single filers and $622,050 for married couples filing jointly. Only income above that level is taxed at the highest rate. Keep in mind that tax brackets are also adjusted each year for inflation, meaning where the bracket starts tend to be adjusted upwards each year. If you live in a state with personal income taxes, you should also account for those in your estimation. Here is a detailed example of how canceled debt could be taxed.

Monthly savings target to cover forgiveness tax

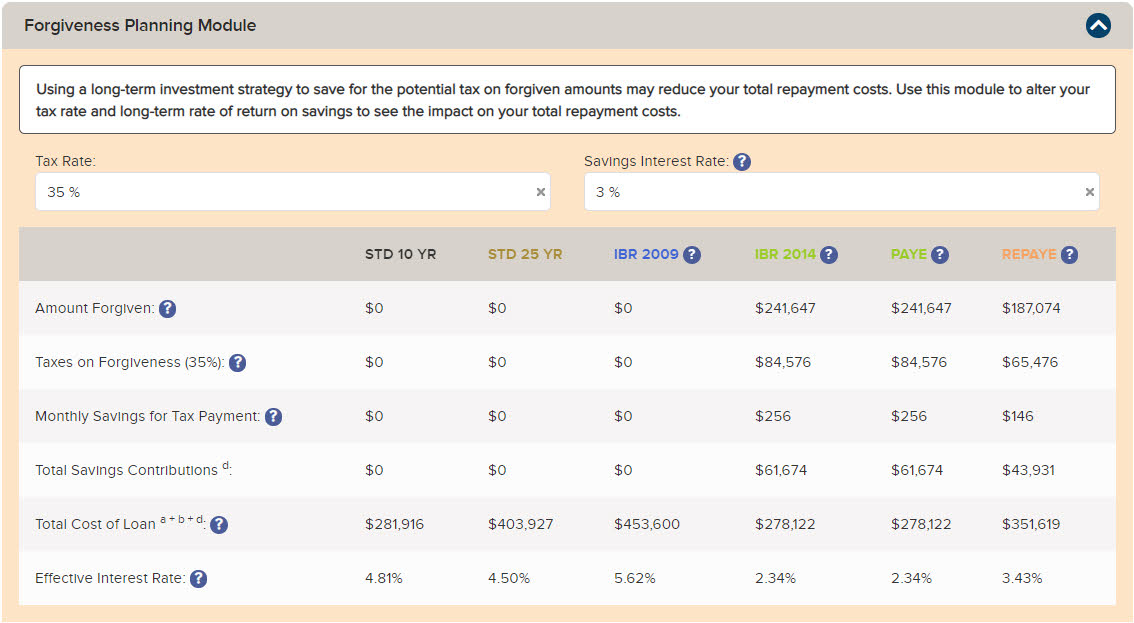

The simplest way to estimate how much you need to save monthly to cover taxes on forgiveness is to divide the projected tax liability by the number of months you have until forgiveness. For example, if you need $100,000 in 20 years (240 months), divide $100,000 by 240 to get $417/mo. However, this presumes that you are saving that money in a coffee can or sticking it under your mattress. More realistically you could save for the tax liability using investments (money market, certificate of deposit, stocks, bonds, real estate, or a combination thereof) and be more likely to earn a return on your forgiveness savings. The “Forgiveness Planning Module” in the VIN Foundation Student Loan Repayment Simulator will help you estimate your savings based on your projected return on those savings. For example, if you were to receive at least a 2% return on your savings, you could reduce a $417/month savings plan to $333/month in order to have $100,000 on hand to cover your forgiveness tax liability in 20 years. Below is an example of the Forgiveness Planning Module for a 2020 DVM with $214,000 of student loan debt projected to be paid back using PAYE.

Building a student loan forgiveness plan is a bit like retirement investing. It depends on your risk tolerance and your comfort with investing. Your options range from saving money in a coffee can to using a certified financial planner (CFP) to manage your plan for you.

The CFP designation is important here, because, CFPs who provide financial planning services usually adhere to the fiduciary standard -- which means their professional code of conduct requires them to act in your best interest. There is a word soup of folks who provide "financial advice." You want to be sure that if you're paying someone to do that, they adhere to that fiduciary standard. It seems silly that would have to even be stated...but welcome to the world of finance. :-) Another good resource for finding fiduciary advisors is the National Association of Personal Financial Advisors (NAPFA.org). From their website, "NAPFA’s position is that the Fee-Only method of compensation is the most transparent and objective method available. This model minimizes conflicts and ensures that your financial planner acts as a fiduciary."

Since there are better ways to save your money than putting it into a coffee can, start by using a website like bankrate.com or nerdwallet.com to find the highest interest rate savings/money market account and/or certificates of deposit (CDs). The default forgiveness savings rate is 3% in the simulator to illustrate how your total student loan repayment costs can decrease if you earn a conservative return on your forgiveness savings plan.

Some think putting some of your forgiveness savings into a mutual fund, target-date funds, exchange-traded fund, stocks, bonds, real estate, etc. makes a lot of sense. And it can... We're talking about long-term savings horizons (20-25 years). However, that also means you have to be comfortable with the risks associated with that type of investing. That said, it's never been easier to invest. "Robo-advisors" like Wealthfront, Betterment, Vanguard, Charles Schwab, Acorns, etc. have made it extremely cheap and easy to invest in any combination of index funds based on your risk tolerance. You can indicate how much you want to invest, or choose an index fund, or your risk tolerance, and the rest is pretty much on auto-pilot.

If you want a more actively managed plan, you can pay a CFP or fee-only financial advisor to help you meet your target(s). They are excellent at helping you formulate an investment plan for reaching long-term targets. You just need to help define the target you're trying to reach. :-) You'll pay them for that management and advice, just like pet owners pay for your specialized veterinary knowledge and advice.