Income-Driven Repayment (IDR) Eligibility

What is your IDR profile?

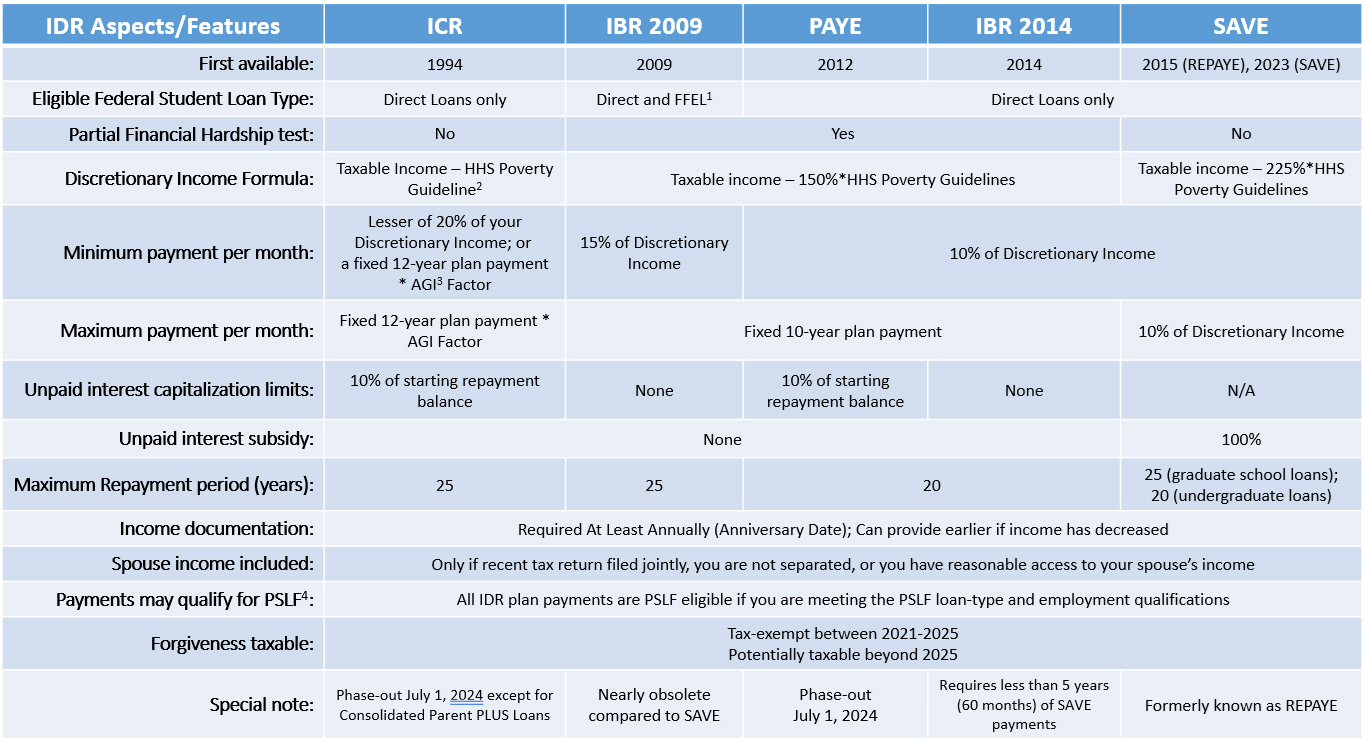

There are several different income-driven repayment (IDR) options for federal student loans. As the name implies, all use your income in a Discretionary Income formula to calculate your minimum monthly payment. You will either pay your balance to zero or reach a maximum repayment timeframe (20-25 years, depending on the plan) whereby any remaining balance is forgiven.

Over time, we have seen IDR plans added, two updated, and two phased out only to be reactivated again. More recently, we’ve also seen the courts get involved and block the newest IDR plan, Saving on a Valuable Education (SAVE).

Brief History of IDR

Not everyone is eligible for the same IDR plans. To better understand IDR eligibility, we need to look at a brief history of IDR. Everyone with federal student loans is eligible for at least one IDR plan, but which IDR plan you’re able to use depends on your loan types and when you started borrowing.

In July 1994, the Income-Contingent Repayment (ICR) option was available for all Direct Loans. ICR is also the only income-driven plan available to Parent Plus borrowers who consolidate their loans into a Direct Consolidation Loan.

Income-Based Repayment (IBR) was added in 2009 and was available for any borrower with Direct Loans and Federal Family Education Loans (FFELs). IBR was updated for new borrowers who first received a Direct Loan after July 1, 2014, creating two mutually exclusive versions of IBR. Anyone who is not a new borrower as of July 1, 2014, is eligible for the original IBR (IBR 2009). New borrowers are eligible for IBR 2014.

Note: You may see IBR 2009 called IBR 2007 or "old IBR." It was created by law in 2007 but was not available until 2009. Similarly, you may see IBR 2014 called IBR 2010 or "new IBR" since the original IBR was updated by law in 2010 but the updates didn't take effect until 2024.

1 FFEL = Federal Family Education Loan

2 HHS Poverty Guidelines: https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines

3 AGI = Adjusted Gross Income, measure from your tax return

4 PSLF = Public Service Loan Forgiveness

Pay-As-You-Earn (PAYE) was first available in 2012. It has the most complicated qualification requirements. To be eligible for PAYE, you must be a new borrower as of October 1, 2007 and receive at least one loan after October 1, 2011. For all intents and purposes, you have to be at least a 2012 veterinary school graduate to be eligible for PAYE.

Saving on a Valuable Education (SAVE) is the newest IDR and an update to the Revised PAYE plan that was first available in 2015. SAVE started in October 2023 after the end of the pandemic forbearance benefits.

In July 2024, a federal appellate court blocked the Department of Education from administering SAVE until litigation around the plan concluded. Anyone who was already in SAVE before the block is receiving an interest-free and payment-free forbearance. The court-imposed block has also paused forgiveness as a feature for any of the Department of Education-created income-driven plans: ICR, PAYE, REPAYE/SAVE. You can still continue to receive forgiveness qualifying payment credit for payments made using ICR or PAYE, but you cannot receive forgiveness if you have completed the required number of qualifying forgiveness payments while the litigation proceeds.

Since IBR was created under separate legislation, forgiveness has not been affected for either of the IBR plans by the SAVE litigation.

IDR Profiles

There are five different income-driven repayment eligibility profiles:

- IDR Profile 1: Eligible for ICR, PAYE, SAVE, and IBR 2014. This is the most flexible profile with the most beneficial available plans. Generally speaking, you must have graduated from veterinary school in 2018 or later to be in this profile.

- IDR Profile 2: Eligible for ICR, IBR 2009, PAYE, and SAVE. This profile is also known as The Pickle due to the potential phase-out of PAYE. Generally speaking, you must have graduated from veterinary school in 2012 or later to be in this profile.

- IDR Profile 3: Eligible for ICR, IBR 2009, and SAVE. Generally speaking, anyone who graduated from veterinary school in 2012 or earlier would be in this IDR profile.

- IDR Profile 4: Eligible for IBR 2009 only. Generally speaking, anyone who graduated veterinary school in 2010 or earlier could be in Profile 4.

- IDR Profile 5: Eligible for ICR only. Borrowers with only Parent PLUS loans that are consolidated into a Direct Consolidation Loan. ICR is the only eligible IDR plan available for Parent PLUS borrowers.

How do I know which IDR Profile I fall into?

The easiest way to find out which income-driven plan profile you’re in is to upload your federal student aid file into the VIN Foundation My Student Loans tool and review the Income-Driven Repayment Eligibility tab. You can watch a video tutorial on how to find your student aid file on My Student Loans. Your veterinary school graduation year can often serve as a guide, but check the Income-Driven Eligibility tab to be sure

Screenshot 2024-08-20 at 9.51.44?AM.png - Caption. [Optional]

![Screenshot 2024-08-20 at 9.51.44?AM.png - Caption. [Optional]](/AppUtil/Image/handler.ashx?imgid=8345348&w=&h=)

Screenshot 2024-08-20 at 9.53.25?AM.png - Caption. [Optional]

![Screenshot 2024-08-20 at 9.53.25?AM.png - Caption. [Optional]](/AppUtil/Image/handler.ashx?imgid=8345353&w=&h=)

Source: VIN Foundation My Student Loans tool, Income-Driven Repayment Plan eligibility Profiles 1- 4

Note: While not shown in the My Student Loans tool, everyone with Direct Loans is also eligible for the original ICR plan. There are only two groups who might benefit from ICR: 1) Parent PLUS loan holders who consolidate into a Direct Consolidation Loan; and 2) Borrowers with a low student debt-to-income ratio who receive a high number of qualifying forgiveness payments under the one-time forgiveness payment count adjustment. The closer you are to forgiveness, the more likely ICR will help you get there when your student debt balance is lower than your income.